vadimignatov.ru

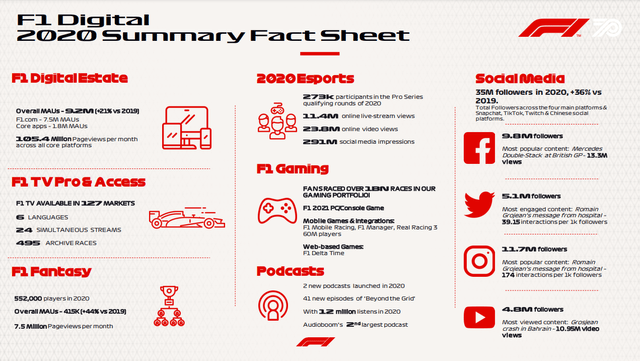

Tools

Formula 1 Stock Ticker

Real time Formula One Group (FWON.K) stock price quote, stock graph, news & analysis. Market capitalization of Formula One Group (FWONK). Market cap: $ Stock prices are delayed, the delay can range from a few minutes to several. Liberty Media Liberty Formula One (FWONK) Receives a Hold from Morgan Stanley. Morgan Stanley analyst Benjamin Swinburne maintained a Hold rating on Liberty. What is Liberty Formula One Group(FWONK)'s stock price today? The current price of FWONK is $ The 52 week high of FWONK is $ and 52 week low is. Stock analysis for Liberty Media Corp-Liberty Formula One (FWONK:NASDAQ GS) including stock price 1 Year Return %. 30 Day Avg Volume 1,, EPS. Research Formula One Group's (Nasdaq:FWON.K) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. Formula One Group (FWONK) stock is nearing its all-time high as the new season starts in Bahrain this week. It jumped by over 4% on Thursday as it closed at. Liberty Media Corporation Series A Liberty Formula One Common Stock (FWONA) The bid & ask refers to the price that an investor is willing to buy or sell a. The Series B Liberty Formula One common stock is quoted on the OTC Markets under the symbol FWONB. Real time Formula One Group (FWON.K) stock price quote, stock graph, news & analysis. Market capitalization of Formula One Group (FWONK). Market cap: $ Stock prices are delayed, the delay can range from a few minutes to several. Liberty Media Liberty Formula One (FWONK) Receives a Hold from Morgan Stanley. Morgan Stanley analyst Benjamin Swinburne maintained a Hold rating on Liberty. What is Liberty Formula One Group(FWONK)'s stock price today? The current price of FWONK is $ The 52 week high of FWONK is $ and 52 week low is. Stock analysis for Liberty Media Corp-Liberty Formula One (FWONK:NASDAQ GS) including stock price 1 Year Return %. 30 Day Avg Volume 1,, EPS. Research Formula One Group's (Nasdaq:FWON.K) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. Formula One Group (FWONK) stock is nearing its all-time high as the new season starts in Bahrain this week. It jumped by over 4% on Thursday as it closed at. Liberty Media Corporation Series A Liberty Formula One Common Stock (FWONA) The bid & ask refers to the price that an investor is willing to buy or sell a. The Series B Liberty Formula One common stock is quoted on the OTC Markets under the symbol FWONB.

The current price of FWONA is USD — it has decreased by −% in the past 24 hours. Watch Liberty Media Corporation - Series A Liberty Formula One stock. Formula One Group Series C. (NASDAQ: FWONK). This is the more popular stock for retail investors to choose out of the three. This stock has no voting rights for. In depth view into FWONK (Liberty Formula One Group) stock including the latest price, news, dividend history, earnings information and financials. View Liberty Media Corp. Series C Liberty Formula One FWONK stock quote prices It operates through the following segments: Sirius XM Holdings, Formula 1, and. FWONA | Complete Liberty Media Corp. Series A Liberty Formula One stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial. View the latest Liberty Media Corp. Series C Liberty Formula One (FWONK) stock price, news, historical charts, analyst ratings and financial information. Stock analysis for Liberty Media Corp-Liberty Formula One (FWONA:NASDAQ GS) including stock price, stock chart, company news, key statistics. Discover real-time Liberty Media Corporation Series A Liberty Formula One Common Stock (FWONA) stock prices, quotes, historical data, news, and Insights for. FWONK support price is $ and resistance is $ (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility. Find the latest Formula One Group (FWONK) stock quote, history, news and other vital information to help you with your stock trading and investing. Formula One Group (vadimignatov.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Formula One Group | Nasdaq: FWONA | Nasdaq. Formula One Group Series C. (NASDAQ: FWONK). This is the more popular stock for retail investors to choose out of the three. This stock has no voting rights for. The Liberty Media Formula One Corp C stock price today is What Is the Stock Symbol for Liberty Media Formula One Corp C? The stock symbol for Liberty. Compared to the opening price on Thursday 09/05/ on BTT of $, this is a drop of %. Liberty Media Corp Registered Shs Series -C- Liberty Formula. Formula 1 does not have publicly listed stocks available for purchase. Instead, one can acquire shares in certain parts of Liberty Media, which is the parent. Delayed price as of PM EDT 09/03/ Formula 1 stock was acquired by the Liberty SiriusXM Group. They IPO'd in August of under the ticker symbol $LSXMK which you can trade. The Formula One group owns: % of Formula 1 · Stock symbol: FWONA · Ordinary Shares: 1 vote. Complete Liberty Media Corp. Series C Liberty Formula One stock information by Barron's. View real-time FWONK stock price and news, along with industry-best. See the latest Liberty Formula One Group A stock price (FWONA:XNAS), related news, valuation, dividends and more to help you make your investing decisions.

Is A Pain And Suffering Settlement Taxable

The short answer is you typically do not pay taxes on personal injury settlement money. Pain and suffering taxes are not taxable. But there are exceptions. Emotional distress: Although pain and suffering damages aren't usually taxable, you may have to pay taxes on compensation received solely for emotional distress. In the case of Personal Injury Damages, the Canadian Revenue Agency (CRA) does not consider awards for pain and suffering taxable income. Income tax is only. Most of the costs that are directly related to injury and recovery are not taxable. These include medical bills, property damage, rehabilitation, assistive. The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section The short answer is: sometimes. The Internal Revenue Service (IRS) taxes some personal injury settlements but considers some non-taxable. Damages that you received for the emotional pain and suffering that you experienced that arose from your physical injuries are also not taxable. However, if you. Before , personal injury settlements were normally tax-free and included damages such as defamation and emotional distress. In most cases, personal injury settlements in Georgia are not subject to tax. And, in rare exceptions, you may only owe taxes on the part of your settlement. The short answer is you typically do not pay taxes on personal injury settlement money. Pain and suffering taxes are not taxable. But there are exceptions. Emotional distress: Although pain and suffering damages aren't usually taxable, you may have to pay taxes on compensation received solely for emotional distress. In the case of Personal Injury Damages, the Canadian Revenue Agency (CRA) does not consider awards for pain and suffering taxable income. Income tax is only. Most of the costs that are directly related to injury and recovery are not taxable. These include medical bills, property damage, rehabilitation, assistive. The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section The short answer is: sometimes. The Internal Revenue Service (IRS) taxes some personal injury settlements but considers some non-taxable. Damages that you received for the emotional pain and suffering that you experienced that arose from your physical injuries are also not taxable. However, if you. Before , personal injury settlements were normally tax-free and included damages such as defamation and emotional distress. In most cases, personal injury settlements in Georgia are not subject to tax. And, in rare exceptions, you may only owe taxes on the part of your settlement.

Generally, you won't pay tax on your personal injury settlement because it's not considered income. This applies to all compensatory damages. In general, a settlement you receive as a result of a personal injury claim is not taxable. For example, assume that an individual won $10, to cover. Before , personal injury settlements were normally tax-free and included damages such as defamation and emotional distress. Internal Revenue Code (IRC) Section provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and. The settlement you receive from a personal injury lawsuit is usually not taxable The money you obtain from pain and suffering damages may be taxable income. The settlement you receive from a personal injury lawsuit is usually not taxable. Morris Bart, LLC explains when your compensation may count as taxable. The settlement amount for a personal injury is not taxable, but any interest earned can be taxed. Settlements, where the amount of compensation is agreed not to. Compensation for pain and suffering is often a large part of a settlement. Money compensating you for emotional distress, pain and suffering, or mental anguish. This position is also applicable to negotiated settlements of wrongful dismissal cases. General damages are not taxable where there is sufficient evidence to. This means that money from the settlement for medical costs, lost wages, pain and suffering, and other losses from physical harm do not need to be reported as. Personal Injury Settlements Are Generally Tax-Free. The Internal Revenue Service (IRS) typically doesn't require you to include your personal injury settlement. Personal injury settlements are tax exempt. Most other types are taxable, meaning winning parties owe portions of settlements to the IRS. The general rule specific to personal injury claims is that the proceeds for compensatory damages are not taxable under federal or state law for physical pain. Most money you receive from a settlement is not taxable in Indiana or at the federal level. However, there are a few instances where you will have to pay taxes. Personal injury settlements are mostly not taxable. Money recovered through a personal injury claim does not need to be reported on a tax return. itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds. Emotional distress, or mental anguish, is defined as the suffering caused by an experience such as a physical injury. Whether the award is taxable depends on. Do I Have to Report Personal Injury Settlement to the IRS? Are personal injury settlements taxable in California? In most cases, personal injury settlements are. When Personal Injury Settlements are NOT Subject to Taxes. As a rule of thumb, any monetary damages recovered via a personal injury settlement are not subject. According to the IRS, if your settlement is a result of a personal physical injury or physical sickness, the compensatory damages you receive are generally not.

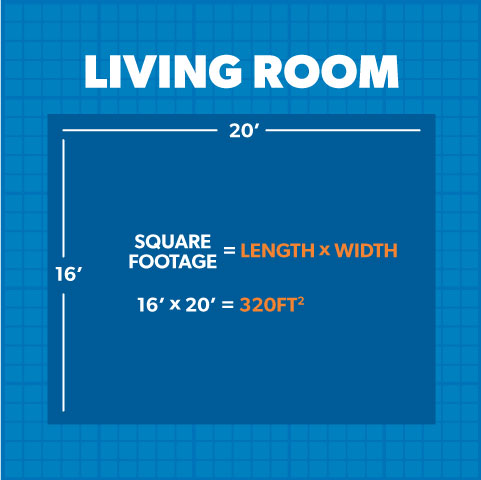

Determining Square Footage Of A Room

The formula involves multiplying the length and width of a room or area to determine its square footage. If the ceiling is angled, it must be 7 feet or higher for at least half of the room's floor area. If it is, then any part of the room with a ceiling of 5 feet . To find the square feet of a room, multiply the length of the room by the width of the room. The length and width can be found by measuring the distance between. Therefore, if you can measure the width and length of the room, you can easily calculate the square footage by simply multiplying the two measurements. The. Step 1: Figure out the square footage of each room in which you want to install laminate-wood floors. To do so, use a tape measure to determine the room's. Once you have measured the length and width of each room, you can calculate the square footage of each room by multiplying the length by the width. Finally, add. Do the math the same way, then divide by to get your total in square feet. When calculating square footage account for the entire space (i.e. under vanity/. Therefore, if you can measure the width and length of the room, you can easily calculate the square footage by simply multiplying the two measurements. The. To calculate the square footage of a space based on square inches, divide the square inches value by Square Inches of a Room / = Square Footage of the. The formula involves multiplying the length and width of a room or area to determine its square footage. If the ceiling is angled, it must be 7 feet or higher for at least half of the room's floor area. If it is, then any part of the room with a ceiling of 5 feet . To find the square feet of a room, multiply the length of the room by the width of the room. The length and width can be found by measuring the distance between. Therefore, if you can measure the width and length of the room, you can easily calculate the square footage by simply multiplying the two measurements. The. Step 1: Figure out the square footage of each room in which you want to install laminate-wood floors. To do so, use a tape measure to determine the room's. Once you have measured the length and width of each room, you can calculate the square footage of each room by multiplying the length by the width. Finally, add. Do the math the same way, then divide by to get your total in square feet. When calculating square footage account for the entire space (i.e. under vanity/. Therefore, if you can measure the width and length of the room, you can easily calculate the square footage by simply multiplying the two measurements. The. To calculate the square footage of a space based on square inches, divide the square inches value by Square Inches of a Room / = Square Footage of the.

Calculating square footage is, luckily, pretty simple. You just multiply the length of a room or house in feet by the width in feet. The basic formula for. For instance, if the room is rectangular, measure the length and width in feet. Then, multiply them together to find the area in square feet. For oddly shaped. The area of a square room is the length of one side multiplied by itself. To be sure the room is an exact square, measure two adjoining sides. How to measure. If you have six (6) sections on the house, each having sq ft of space, the total area would be 3, sq ft. The unconditioned areas should be separated and. To measure a rectangular room, use a tape measure, pencil and paper to record the length and width of the room. Then multiply these numbers to get the total. Assuming the room is rectangular and the lengths are in metres, multiply the length by then multiply the width by Multiply. YES. The area of a room = length x width = square feet or meters. Whichever you are using,, when estimating volume you add in height. Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. That means walking through each room and measuring its length and width with a tape measure or laser measurement tool. You multiply the length and width of each. Square footage is a measurement that represents the total area of a space, typically expressed in square feet. To calculate the square feet of an 'L' shaped room or area, divide the shape up into rectangular sections and treat each one as a separate area for calculation. in width, you would multiply the two figures ( x ) to determine the square footage, which equals square feet. Step 4. If the room or area you. Multiply the length by the width to create the square foot measurement for the room. If the length is 14 feet and the width is 10 feet, you have a calculation. To calculate square feet using feet, simply multiply the length of the area by its width in feet. For instance, if a room is 10 feet long and 15 feet wide. With your tape measure, pencil, and paper in hand, start by measuring the rooms where you currently live as a point of comparison. The square footage. To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. Go room by room, measuring the length and width. Then, multiply those figures by one another to get the square footage of that space. Calculating a room's square footage is simple: multiply the length of the room by its width. Let's suppose a room in your house is 30 feet wide by 20 feet long. Multiply the rectangle's length by its width to get the area in square feet. Write this number down in the corresponding space on your sketch. Add up the total. These means: 4 x 2 = 8, 4 x 2 = 8, and 8 x 12 = Then add 8 + 8 + 96 = The total square footage of the room would be square feet. Learning.

How Much Is A Charge At A Tesla Charging Station

Although often higher in California, average pricing at Tesla Superchargers is typically around $ per kWh. You can expect it to cost between $$25 to. chargers. Level 2 charging stations allow EV owners to charge their vehicles while parked at home, at work, or on the street. DC fast chargers offer a. The closest supercharger varies from $ - $ based on time. There is a charger a few miles away that is consistently $ Tesla has restricted access on some stations, particularly in dense areas such as major cities, and any stations that lack the software or hardware to support. Three Ways to Charge at Home · Mobile Connector · Wall Connector · Universal Wall Connector. We left our house fully charged. We topped up at several Tesla superchargers and the cost ranged from about $2 to around $ Total cost for the. A Model 3 would cost $ per day. For a Model X, this Tesla driver would spend $ a day to recharge. With a Model Y, the charging cost is $ At the. For the standard variant, which offers an impressive range of miles, a full charge costs approximately $ This calculation is based on an electricity. As of November 15th, , Tesla's fee for use of kW superchargers (Level-3) in my region of NYS is 42 cents per kWh. · Tesla offers two. Although often higher in California, average pricing at Tesla Superchargers is typically around $ per kWh. You can expect it to cost between $$25 to. chargers. Level 2 charging stations allow EV owners to charge their vehicles while parked at home, at work, or on the street. DC fast chargers offer a. The closest supercharger varies from $ - $ based on time. There is a charger a few miles away that is consistently $ Tesla has restricted access on some stations, particularly in dense areas such as major cities, and any stations that lack the software or hardware to support. Three Ways to Charge at Home · Mobile Connector · Wall Connector · Universal Wall Connector. We left our house fully charged. We topped up at several Tesla superchargers and the cost ranged from about $2 to around $ Total cost for the. A Model 3 would cost $ per day. For a Model X, this Tesla driver would spend $ a day to recharge. With a Model Y, the charging cost is $ At the. For the standard variant, which offers an impressive range of miles, a full charge costs approximately $ This calculation is based on an electricity. As of November 15th, , Tesla's fee for use of kW superchargers (Level-3) in my region of NYS is 42 cents per kWh. · Tesla offers two.

Each site has multiple Superchargers to get you charged and back on the road quickly. Overview. Overview Show All. The cost to charge your Tesla at a charging station can range from free to $ Several factors can change this cost, the most important being the size of your. Simply plug in, charge and go. With 50,+ Superchargers, Tesla owns and operates the largest global, fast charging network in the world. Located on major. Find key specifications for the Tesla Model 3 electric car including driving range, charging time, price, and the ideal charging station. We topped up at several Tesla superchargers and the cost ranged from about $2 to around $ Tesla connectors at hundreds of EVgo fast charging stations across the U.S.! How much will it cost to charge my Tesla? How do I pay to charge my Tesla. The level of battery charge, connector power rating, and on-board charger options can be tailored to your requirements for more accurate results. How much does. When using a Supercharger, Tesla recommends only charging to around 80% due to how slowly the battery charges for the last 20%. This also ensures the. For more information refer to the Charger Installation Guide. Charging Tip: Many public charging stations are free to use. For those that are pay-per-use, the. Find key specifications for the Tesla Model 3 electric car including driving range, charging time, price, and the ideal charging station. How Much Does It Cost to Charge a Tesla Model 3? Pricing at Superchargers varies by location, but the cost is typically about $ per kWh. A full recharge to. The cost to fully charge a Tesla with a Supercharger can range from $6 to over $50, depending on the rates and fees at the Supercharger station. Superchargers. Installing a new V outlet can cost $ - $1, Charging speed is up to 3 mph with a standard household outlet, or up to 30 mph with a V outlet. †. Simply plug in, charge and go. With 50,+ Superchargers, Tesla owns and operates the largest global, fast charging network in the world. Located on major. Public Level 2 charging stations are essentially the same as the charging stations most EV owners have at home. They charge an EV much more quickly than a. Installing a new V outlet can cost $ - $1, Charging speed is up to 3 mph with a standard household outlet, or up to 30 mph with a V outlet. †. When using a Supercharger, Tesla recommends only charging to around 80% due to how slowly the battery charges for the last 20%. This also ensures the. The fee for NYPA chargers is only $/kWh + tax, with no additional session or idle fees. The average NY driver can save an average of $ to $1, a year. At most Tesla Supercharging stations in the US, the rate is $ per kWh, or about double the average home rate, so around $14 or at a Supercharger, using the. Depending on the type of charging station, you can easily spend $ to $ But these costs may be much higher if you install a separate electrical panel and.

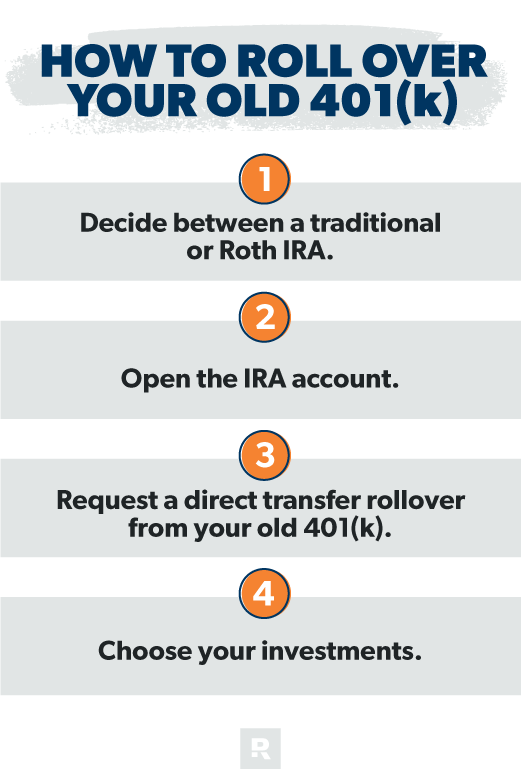

How To Roll Over A 401k To New Employer

If allowed, consolidate your (k)s into one account with your new employer, continuing tax-deferred growth potential. Investment options vary by plan 3. You can also have your financial institution or plan directly transfer the payment to another plan or IRA. The rollover chart PDF summarizes allowable rollover. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without incurring taxes or. Moving your retirement plan money with you when you change jobs may be an option to consider. Make sure to review your new employer's policy on rollovers. 1. Keep your (k) in your former employer's plan · 2. Roll over the money into an IRA · 3. Roll over your (k) into a new employer's plan · 4. Cash out. Rollover from a Previous Employer into a Peach State Reserves (PSR) (k) or · Access your account on GaBreeze · Click on the Savings & Retirement tab · Under. You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires. Inform your former employer that you want to roll over your (k) funds into an IRA. Make sure the check is payable to the financial services company, instead. Keep your (k) with your former employer. Roll over the money into an IRA. Roll over your (k) into a new employer's plan. Cash out. If you. If allowed, consolidate your (k)s into one account with your new employer, continuing tax-deferred growth potential. Investment options vary by plan 3. You can also have your financial institution or plan directly transfer the payment to another plan or IRA. The rollover chart PDF summarizes allowable rollover. A direct (k) rollover gives you the option to transfer funds from your old plan directly into your new employer's (k) plan without incurring taxes or. Moving your retirement plan money with you when you change jobs may be an option to consider. Make sure to review your new employer's policy on rollovers. 1. Keep your (k) in your former employer's plan · 2. Roll over the money into an IRA · 3. Roll over your (k) into a new employer's plan · 4. Cash out. Rollover from a Previous Employer into a Peach State Reserves (PSR) (k) or · Access your account on GaBreeze · Click on the Savings & Retirement tab · Under. You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires. Inform your former employer that you want to roll over your (k) funds into an IRA. Make sure the check is payable to the financial services company, instead. Keep your (k) with your former employer. Roll over the money into an IRA. Roll over your (k) into a new employer's plan. Cash out. If you.

Roll Over Your (k) into a New Employer's (k) Plan · Make the check payable to Depository Services · Include your Digit Account Number · Include the name. Cons · Limited opportunity for early withdrawals without paying a 10% early-withdrawal additional tax (early tax is not due for amounts rolled over) · Loans are. To roll over a (k) from one company to another, contact the new provider, complete necessary paperwork, and coordinate the transfer. You don't have to roll over your (k), but when you leave your money with your former employer's plan, your investment choices are limited to what's available. Changing jobs? Here are five ways to handle the money in your employer-sponsored (k) plan, including some pros and cons of each. There's no required timeframe for rolling over your (k). If your balance is less than $5,, your previous plan may be required to roll over your account. What are my options for my (k)? · Option #1: Leave it in your former employer's (k) plan, if allowed by the plan. · Option #2: Move it to your new. To roll over a (k) to a new employer, you can either request a direct rollover between the two (k)s or have the money transferred to your bank account and. Get started · Roll assets to an IRA · Leave assets in your former employer's QRP, if QRP allows · Move assets to your new/existing employer's QRP, if QRP allows. Once you leave your company, you may be eligible to rollover your Guideline (k) funds into your new employer's plan. Follow these 3 easy steps · If you're rolling over pre-tax assets, you'll need a rollover IRA or a traditional IRA. · If you're rolling over Roth (after-tax). Roll over your money to a new (k) plan, if this option is available If you're starting a new job, moving your retirement savings to your new employer's. Personally, I wouldn't roll it over to a new employer, I would roll it over to an IRA using a low cost brokerage company. Then, you would need to call your previous employer with your new account information on hand. This needed information will likely include the new account. If you don't already have a rollover IRA, you'll need to open one—this way, you can move money from your former employer's plan into this account. If there are. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. If you have a (a) with your employer in the public sector and leave for a position in the private sector, you may be offered a (k) in your new role. You. An indirect rollover is when you get a check from your previous employer (k) or Plan. The previous employer usually withholds 20% of this check for. The first step in transferring an old (k) to a new employer's qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources. Compare the fees, expenses, and services associated with each option including staying in plan, rolling over to an IRA, or rolling over to your new employer's.

How Do I Get Paid With Instacart

The average pay per order on Instacart is now between $5-$ in all of the US with the aforementioned exceptions. This base pay does not change based on the. How much can Instacart drivers earn? Instacart shoppers get paid $11 — $16/hour on average; Three main driver expenses: gas, auto insurance, car. Yes, Instacart pays shoppers based on the time and distance required for each order, as well as incentives for peak times and high-demand areas. Without tips, we'd make under $10 an hour (truly only between $$) for the average item grocery order and that's before gas and taxes. Instacart. Yes, Instacart pays shoppers based on the time and distance required for each order, as well as incentives for peak times and high-demand areas. Add a payment method · Tap the Account icon · Tap Settings · Select the payment method under Payment methods · Tap Add next to the payment method you would like. The average Instacart Shoppers salary ranges from approximately $ per year for Driver (Independent Contractor) to $ per year for Store Shopper. An Instacart shopper may fill one of two roles: full-service shopper or in-store shopper. Both earn weekly payouts and perform comparable work in store. The average pay for Instacart shoppers is quite elusive. Depending on which source you reference, the average pay is anywhere from $10 to $17 per hour. The average pay per order on Instacart is now between $5-$ in all of the US with the aforementioned exceptions. This base pay does not change based on the. How much can Instacart drivers earn? Instacart shoppers get paid $11 — $16/hour on average; Three main driver expenses: gas, auto insurance, car. Yes, Instacart pays shoppers based on the time and distance required for each order, as well as incentives for peak times and high-demand areas. Without tips, we'd make under $10 an hour (truly only between $$) for the average item grocery order and that's before gas and taxes. Instacart. Yes, Instacart pays shoppers based on the time and distance required for each order, as well as incentives for peak times and high-demand areas. Add a payment method · Tap the Account icon · Tap Settings · Select the payment method under Payment methods · Tap Add next to the payment method you would like. The average Instacart Shoppers salary ranges from approximately $ per year for Driver (Independent Contractor) to $ per year for Store Shopper. An Instacart shopper may fill one of two roles: full-service shopper or in-store shopper. Both earn weekly payouts and perform comparable work in store. The average pay for Instacart shoppers is quite elusive. Depending on which source you reference, the average pay is anywhere from $10 to $17 per hour.

Apply to shop and start earning today. Sign up now and see why shoppers choose Instacart for flexible earnings. Average hourly pay for Instacart Delivery Driver: $ This salary trends is based on salaries posted anonymously by Instacart employees. Getting a payment card is simple. New shoppers usually receive their payment card in the mail 5 to 7 business days after completing the signup process. Instacart pays $7 per batch as base pay no matter how many items are in the order. If it is more than 5 miles to the customer's house they may. If you are a new Instacart shoppers or thinking about becoming one, you may want to know how much you can make. They get paid per order and the price is shown per batch. They wire the money to your bank account or you can set up a account with their bank. How Does Instacart Pay? Instacart pays drivers per order. The exact amount you'll get varies based on many factors. It all depends on how many items are in. From becoming a personal shopper or an Instacart driver you can earn extra cash for helping somebody do their food shopping - it's really that simple. Download. If you've already exhausted your opportunities on Instacart and want to try other jobs like Instacart, the following twenty options could be worth a try. Challenge. Instacart facilitates a multi-sided grocery marketplace with complex payment needs. · Solution. Instacart runs Stripe on AWS, which enables all. Add a payment method · Tap the Account icon · Tap Settings · Select the payment method under Payment methods · Tap Add next to the payment method you would like. Get paid for going to stores and delivering orders to customers—all on your own schedule. The Instacart Shopper app makes it easy to earn money with total. To be eligible to become an Instacart shopper in the U.S, you must be at least 18 years of age, have legal authorization to work in the U.S., be able to lift up. A new analysis of more than 1, Instacart pay records finds that the average Instacart worker is paid just $/hour, after accounting for the costs of. Depending on which source you reference, Instacart pays anywhere between $10 to $17 per hour, plus tips and bonuses. According to vadimignatov.ru EARN EIGHTY CENTS AN HOUR BY DELIVERY GROCERIES WITH INSTACART! Yep, that's right. Eighty cents. That's what Instacart actually paid Tom, an Instacart worker. How much does an Instacart Delivery make? As of Aug 31, , the average hourly pay for an Instacart Delivery in the United States is $ an hour. While. Salaries by job title at Instacart ; Store Shopper. 1K Salaries submitted. $31K-$42K · $36K | $0 ; Personal Shopper. Salaries submitted. $31K-$46K · $38K | $0. So while the average Instacart salary is $63, there is a big variation in pay depending on the role. SAP Security Consultant. Highest paying jobs at. You can make Instacart Mastercard® payment online, by phone, through the Chase mobile app, by mail or at a branch. To pay Instacart Credit Card bill online.

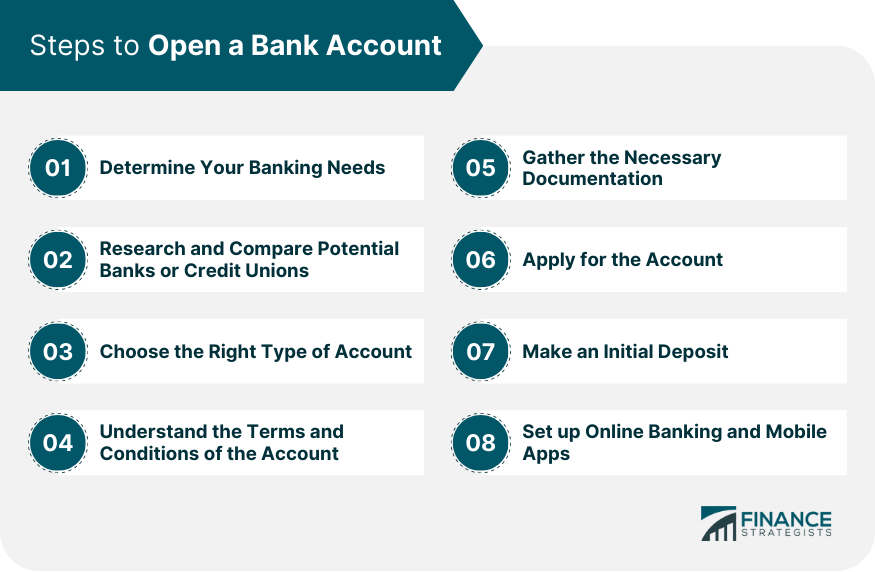

Bank Account Opening Process

What You'll Need to Open a Checking Account · 1. Valid form of identification · 2. Sufficient funds for an initial deposit · 3. Basic information · 4. Co-applicant. A bank account can be opened in one of two ways: online or offline. One can either seek a new bank account in a nearby branch or begin the process online by. What does it take to open a bank account online? · Go to the bank's website. Stay safe! · Choose the type of account you want. Most banks let you compare. Open a Savings Account online with HDFC Bank through your mobile phone or laptop through InstaAccount. You can initiate the process with just your mobile number. What documents do you need to open a US bank account? · Valid passport · Individual Taxpayer Identification Number (ITIN) · Government-issued ID · Proof of address. How to Open a Current Account? · Check your eligibility criteria for opening a Current Account. · Download the account opening form from the bank's website. · Fill. To open a checking account at a bank branch you'll typically need to bring a government-issued ID, an SSN or TIN card, and proof of address, but more may be. What's required to open a checking account is probably right at your fingertips. If you open it in person, you'll likely need two forms of ID (such as a. When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. What You'll Need to Open a Checking Account · 1. Valid form of identification · 2. Sufficient funds for an initial deposit · 3. Basic information · 4. Co-applicant. A bank account can be opened in one of two ways: online or offline. One can either seek a new bank account in a nearby branch or begin the process online by. What does it take to open a bank account online? · Go to the bank's website. Stay safe! · Choose the type of account you want. Most banks let you compare. Open a Savings Account online with HDFC Bank through your mobile phone or laptop through InstaAccount. You can initiate the process with just your mobile number. What documents do you need to open a US bank account? · Valid passport · Individual Taxpayer Identification Number (ITIN) · Government-issued ID · Proof of address. How to Open a Current Account? · Check your eligibility criteria for opening a Current Account. · Download the account opening form from the bank's website. · Fill. To open a checking account at a bank branch you'll typically need to bring a government-issued ID, an SSN or TIN card, and proof of address, but more may be. What's required to open a checking account is probably right at your fingertips. If you open it in person, you'll likely need two forms of ID (such as a. When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started.

Open a Wells Fargo checking account online in minutes. Get Mobile Banking, Bill Pay, and access to ATMs. You can apply for an individual bank account if you're 18 years or older and a legal U.S. resident. You'll need to provide your Social Security number and a. However, you must keep your own money separate from their accounts. When opening the account, the bank usually requires a legal power of attorney document and a. Issuers can opt into the Open Banking for Account Opening Program to secure and streamline the digital account opening process. What do I need to open a checking account? · Identification. · Proof of address. It must show your name and address of your residence. · Opening deposit. You may. Wherein, after entering your details, you will have the option to get on a video call with our bank executive to complete your KYC process. The video call will. Our secure application process should only take about 10 minutes. Keep in Bank Account and Routing Number. Step 3. Choose the following: Password. For opening Savings Account online, all you need is a mobile number for initiating the process. One just needs to submit the application and attach documents. Setting up credit union membership is an easy two-step process. You may be required to deposit a minimum of $10 to your new checking when opening account(s). Whatever your financial goals are, we've got a bank account to help get you there. Special offers for students, seniors, newcomers to Canada and more. The interest they pay for savings accounts. You usually need to make an initial deposit between $25 and $ to open a savings or checking account. Tip. Find. A Corporation bank account is a separate bank account for your business. Learn how to open a Corporation bank account with Bank of America. Applying for a bank account online is quick, easy and secure – it takes just 5 to 10 minutes to open a bank account. Step 1: Gather Required Documents · Step 2: Review Bank Terms and Features to Narrow Choices · Step 3: Select the Right Banking Provider and Type of Bank Account. Reward Processing: The reward will be deposited to the new business checking account within 4 weeks after the qualification requirements have been met and. Savings & Salary Account Online with HDFC Bank Digital Savings Account, all account opening process, you can do all your banking using this account. Yes, you can open a checking account online. Most banks provide a simple and secure online bank account application process. To open a UMB account online, you. Scan & Pay instantly! T&Cs. Refresh your finances with a fulfilling credit card from ICICI Bank. Explore Now. Credit Cards. You will likely need an initial deposit to open your checking account or your savings account. For checking accounts, this can be as low as $25 or $ Open Savings account online with IndusInd Bank. Open Bank Account Online with high savings account interest rate up to %. Open Savings Account Now!

Best Penny Stock Predictions

PennyGems: Penny Stocks Scanner App makes it easy to search and find great Penny stocks to buy from stocks under $5, follow your favorite stocks. Best Penny Stocks Under 10 Cents Right Now ; #1 - Maxeon Solar Technologies. NASDAQ:MAXN. Stock Price: $ (-$). P/E Ratio: Market Cap: $ Find and compare the best penny stocks under $2 in real time. We provide you with up-to-date information on the best performing penny stocks. Top 10 Penny Stocks ; ITRM, ; VUZI, ; RVSN, ; LILM, The 10 Best Penny Stocks · 1 - Chesapeake Energy (OTCMKTS: CHKAQ) · 2 - Mid-Con Energy Partners LP (NASDAQ: MCEP) · 3 - Advantage Oil and Gas Ltd. (NYSE: AAV) · 4 -. List of Penny stocks ; South Indian Bank, ₹ ; Reliance Power, ₹ ; Vodafone Idea, ₹ ; Bank of Maharashtra, ₹ This page displays the best penny stocks making the biggest moves over the last 5 days. Sorted by 5-day percent change, and with a 5-day average volume greater. investing writer at vadimignatov.ru, in his feature on penny stocks. One choice investors have is to buy fractional shares of a stock whose price exceeds what. On vadimignatov.ru you will find a comprehensive list of Penny Stocks & discover the best Penny Stocks to buy, top penny stock news and micro-cap stock. PennyGems: Penny Stocks Scanner App makes it easy to search and find great Penny stocks to buy from stocks under $5, follow your favorite stocks. Best Penny Stocks Under 10 Cents Right Now ; #1 - Maxeon Solar Technologies. NASDAQ:MAXN. Stock Price: $ (-$). P/E Ratio: Market Cap: $ Find and compare the best penny stocks under $2 in real time. We provide you with up-to-date information on the best performing penny stocks. Top 10 Penny Stocks ; ITRM, ; VUZI, ; RVSN, ; LILM, The 10 Best Penny Stocks · 1 - Chesapeake Energy (OTCMKTS: CHKAQ) · 2 - Mid-Con Energy Partners LP (NASDAQ: MCEP) · 3 - Advantage Oil and Gas Ltd. (NYSE: AAV) · 4 -. List of Penny stocks ; South Indian Bank, ₹ ; Reliance Power, ₹ ; Vodafone Idea, ₹ ; Bank of Maharashtra, ₹ This page displays the best penny stocks making the biggest moves over the last 5 days. Sorted by 5-day percent change, and with a 5-day average volume greater. investing writer at vadimignatov.ru, in his feature on penny stocks. One choice investors have is to buy fractional shares of a stock whose price exceeds what. On vadimignatov.ru you will find a comprehensive list of Penny Stocks & discover the best Penny Stocks to buy, top penny stock news and micro-cap stock.

Best Penny Stocks Under 10 Cents · Medical Marijuana (OTCPK:MJNA) · Caduceus Software Sys (OTCPK:CSOC) · Virtual Medical Intl (OTCEM:QEBR) · Fiore Cannabis (OTCEM. Yes, the stock price has dropped - because institutions are reducing Dilution of a penny stock · Hi traders and investors! How can I check if a penny. Penny stocks are stocks of small-cap companies that trade at extremely low prices, often trading in the range of Rs. 50 per share. Investors are on the. Stock ForecastTrending StocksStrong Buy StocksHighest Earnings StocksBest StocksBest Penny Stocks to Buy NowBest Stocks Under $5Best Stocks Under $ My top 3 penny stocks to buy now (as long as their price action is strong) are BranchOut Food Inc (NASDAQ: BOF), Neonode Inc (NASDAQ: NEON), and AST SpaceMobile. Here's a list of penny stocks that are trading at a price below Rs 20 and have the potential for significant growth. For only $ per year, we give you our best high-quality, low-priced stock picks. Along with a full team, Peter Leeds is the widely-recognized authority on. Penny stocks are low-priced and high-risk, often leading to significant investor losses. · Invest in companies with substantial revenues and realistic growth. The Best Stocks Under $1 at a Glance ; NYSEAMERICAN: JOB. $ $m. , ; NASDAQ: AYLA. $ $m. 59, Penny stocks that pass the proper analysis can quickly multiply in value, dramatically outperforming every other type of stock, including so-called "safe" blue. [SERIOUS] Best legit penny stock plays of What are you most bullish on this year? Serious bets / skin in the game plays only. I'm betting. Penny stocks — US stocks ; FOXO · D · USD, −% ; STBX · D · USD, +% ; GLYC · D · USD, −% ; NCNC · D · USD, −%. Penny stocks are public companies that have a current share price of $ or less. These companies are listed on major stock exchanges and have market. Read along for our top picks. We're breaking down what companies you want to keep an eye on and an overview of all the penny stocks on our list. Find our top penny stocks here and learn how to take a position on them in the UK through trading or investing. These shares have been selected for their. Stocks under 10 cents: Daily Price Predictions of Stocks with Smart Technical Market Analysis. Absolutely Grab one, RSI for example, on a penny stock, timeseries per close of business day. Check buy at 30 and sell at 70 in the windows of. Predictions · Portfolios · Screener · Watchlists · Dividend Calendar · Earnings Top Stocks · Golden Star; Meet AI Analyst. Pricing & Plans. Profile. Sign In. These stocks, which trade under $5 per share, are usually priced that low for a good reason. For example, a penny stock could belong to a once-thriving company. PennyGems: Penny Stock Screener App makes it easy to search, find, scan, and track great Penny stocks. Choose from 2, stocks under $

Win Paypal Cash Free

You can earn free PayPal gift cards for completing different online tasks and activities like shopping online for cash back, redeeming promo codes, or taking. I think that Google Play, Paypal and Cash App should get together and put a stop to these games. On Free Cash you can cash out as soon as you. Are streaming prices to high?! try streamEarn and start to Earn paypal money with our income app. Win free PayPal cash and PayPal gift cards. Wealth Words pays its users through PayPal, with a minimum cash-out requirement of $ Play and Win (Android & iOS – Free). Play and Win is a platform that. Want to influence the future and direction of societies, citizens, and brands? Share your views and earn rewards by completing online surveys at Ipsos iSay. ☑️Stream Earn is a income app for real money games paypal to earn paypal money. Join our free paypal app for paypal cash! Just choose a game and play it. Have. Earn FREE PayPal Money by answering paid surveys, playing games, or watching videos. Sign up now and get started! That's it! Gigs pay between 3 and 25 dollars, and you'll usually get paid within 72 hours. This side hustle is a great way to earn money for dinner dates, movie. One of our new favorite ways for getting free PayPal cash involves using Kashkick, a leading rewards platform. What's nice about Kashkick is that it has plenty. You can earn free PayPal gift cards for completing different online tasks and activities like shopping online for cash back, redeeming promo codes, or taking. I think that Google Play, Paypal and Cash App should get together and put a stop to these games. On Free Cash you can cash out as soon as you. Are streaming prices to high?! try streamEarn and start to Earn paypal money with our income app. Win free PayPal cash and PayPal gift cards. Wealth Words pays its users through PayPal, with a minimum cash-out requirement of $ Play and Win (Android & iOS – Free). Play and Win is a platform that. Want to influence the future and direction of societies, citizens, and brands? Share your views and earn rewards by completing online surveys at Ipsos iSay. ☑️Stream Earn is a income app for real money games paypal to earn paypal money. Join our free paypal app for paypal cash! Just choose a game and play it. Have. Earn FREE PayPal Money by answering paid surveys, playing games, or watching videos. Sign up now and get started! That's it! Gigs pay between 3 and 25 dollars, and you'll usually get paid within 72 hours. This side hustle is a great way to earn money for dinner dates, movie. One of our new favorite ways for getting free PayPal cash involves using Kashkick, a leading rewards platform. What's nice about Kashkick is that it has plenty.

Earn up to $ With PayPal, there's a plus side to everything you do — like earning up to $ cash back (10, points) when you refer up to ten of your. e platforms offer cash sweepstakes where users can enter to win larger sums of PayPal cash. These sweepstakes often require users to use their. SpinPayApp - Earn Free Paytm, Paypal Cash - SpinPayApp is a Gaming App through Which You can Play Lucky-Wheel, Scratch Card, other Games and at the Same. Whether you're placing a bet, gaming online, or sending money internationally, Skrill makes every payment quick and secure. Freeward is a legitimate rewards platform that lets you earn free PayPal money for easy and fun activities. The minimum payout amount is $5, and you can also. Learn how to make money online with side hustles with our Get Paid to Test program. One of the easiest ways to earn money if you're looking for side hustle. Swagbucks is a popular rewards and cash-back site that offers a number of ways to earn free PayPal money, including answering surveys and getting rebates. Earn free gift cards and money by playing free games. It's time you grow and become your own boss. Don't miss this lucky day! All you have to do is play and. There are many websites that allow you to play games and receive your paypal free $5 dollars email. You can play games such as trivia, puzzle, arcade, etc. and. Hi, I want to earn money by walking but every app that I've downloaded uses either bank transfer, free items or bids on gift cards. Earn interest on your cash back. Roll your cash back into a high-yield PayPal Savings account. · Settle up with friends, fast and safe. At the table or across. Absolutely, there are tons! 1. FreeCash 2. Drumo 3. Scrambly 4. mCrypto 5. Earn/Mode 6. Mistplay 7. JustPlay 8. Swagbucks 9. InboxDollars. If you're looking for another platform to earn PayPal money, check out InboxDollars. Accessible as both a user-friendly website and mobile app. HOW TO REQUEST PAYMENTS TO YOUR PAYPAL ACCOUNT · Sign up for free at vadimignatov.ru · Take part in online surveys to earn points and cash. · Earn a minimum of $1. Swagbucks is a popular rewards and cash-back site that offers a number of ways to earn free PayPal money, including answering surveys and getting rebates. Shop to earn. Each eligible purchase grants cash back.1 Use your PayPal Cashback Mastercard on PayPal purchases. You'll earn another 3% on top A mobile phone. PrizeRebel – Earn gift cards and PayPal cash · Click on the green button below · Sign up for an account · Start doing surveys and earning · It's a great site to. This classic game allows you to win real money paid out through your PayPal account. With Bingo Cash, you need to work quickly. But you want to ensure you don't. Additionally, you can earn money on Swagbucks for a variety of activities. Earn money online and PayPal cash when you complete paid online surveys, make. Earn up to £20 with today's must-have apps. Sign up and choose PayPal as your payment method in up to 4 of these select apps below.

Whole House Warranty Plans

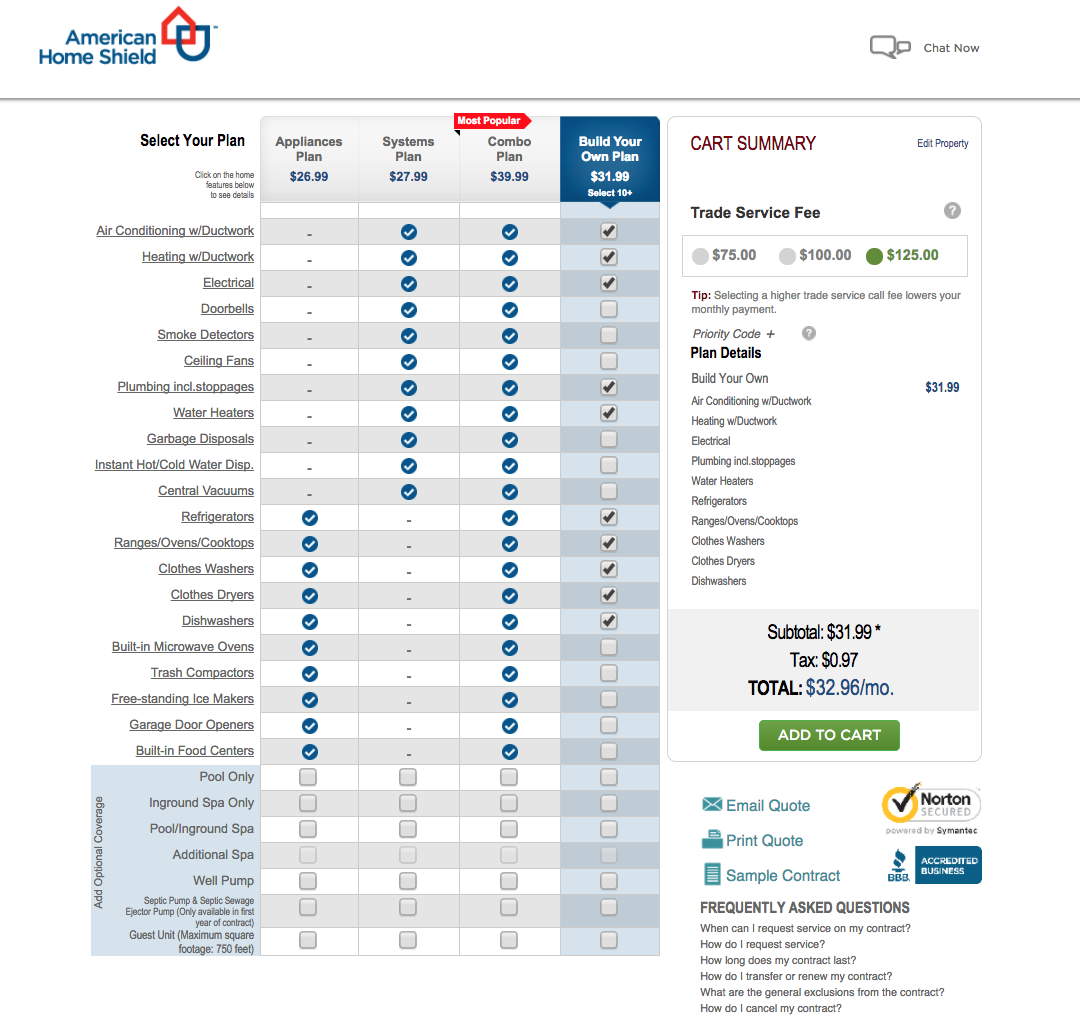

Get a quote. Purchase home warranty coverage to protect your budget when your critical home systems and appliances break down. A home warranty or Home Service Plan is an annual service contract that can provide coverage for things that homeowners insurance doesn't. A Home Warranty. It provides three different plans to choose from: a systems-only plan, an appliance-only plan, and a plan that covers both. These plans can be purchased as-is. AB May Plans give Kansas City homeowners a plan for whenever problems pop up. An AB May Home Warranty is initiated when selling or purchasing a home. In most cases, the annual average cost of a home warranty ranges from $ to $, making the average monthly payment around $30 – $ You should also expect. A home warranty is a service contract that covers the cost of repairs or replacement of home systems and appliances. Home warranties do not cover home. Home warranty coverages will vary based on the plan you select, but can protect nearly all your home essentials—including optional coverage for pools and spas. An Old Republic home warranty plan safeguards your budget from expensive repairs and helps keep your home systems and appliances operating efficiently. We researched the top national home warranty companies to find the best providers to protect your major systems and appliances. Read on to learn more. Get a quote. Purchase home warranty coverage to protect your budget when your critical home systems and appliances break down. A home warranty or Home Service Plan is an annual service contract that can provide coverage for things that homeowners insurance doesn't. A Home Warranty. It provides three different plans to choose from: a systems-only plan, an appliance-only plan, and a plan that covers both. These plans can be purchased as-is. AB May Plans give Kansas City homeowners a plan for whenever problems pop up. An AB May Home Warranty is initiated when selling or purchasing a home. In most cases, the annual average cost of a home warranty ranges from $ to $, making the average monthly payment around $30 – $ You should also expect. A home warranty is a service contract that covers the cost of repairs or replacement of home systems and appliances. Home warranties do not cover home. Home warranty coverages will vary based on the plan you select, but can protect nearly all your home essentials—including optional coverage for pools and spas. An Old Republic home warranty plan safeguards your budget from expensive repairs and helps keep your home systems and appliances operating efficiently. We researched the top national home warranty companies to find the best providers to protect your major systems and appliances. Read on to learn more.

With prices starting at $ per month, American Home Shield protects your budget by beating the national average home warranty cost of $ to $ a. Home warranty companies are about as useful as warranties on small electronics and video games. It'll cost you more to replace it through the. A home warranty plus a whole lot more · ✓Dishwasher · ✓Garbage Disposal · ✓Garage Door Opener · ✓Water Heater · ✓Air Conditioning · ✓Heating Systems. We offer coverage for parts of your major home systems like heating and air conditioning, electrical and plumbing, kitchen and laundry appliances, and much more. A Home Warranty from Sears is a protection plan that covers multiple appliances and systems in your home. Choose from appliance, systems, or whole house. It provides three different plans to choose from: a systems-only plan, an appliance-only plan, and a plan that covers both. These plans can be purchased as-is. See all protection plans from Select Home Warranty. Get details and pricing to find the best option for you. Save with $ OFF any plan. A home warranty plan protects the appliances and systems in your home: major home appliances, electrical, plumbing, and HVAC systems. Compare our Home Warranty Plans. ; Total · $/mo ; Systems · $/mo ; Appliance · $/mo. What Does a TotalHome Warranty Combo Plan From HomeServe Cover? · Central Vacuum · Clothes Dryer · Clothes Washer · Dishwasher · Kitchen Refrigerator · Garage Door. Compare home warranty plans from Home Buyers Warranty, Best Company's Most Trusted Warranty Company, and get a quote that fits your needs today! A home warranty is a protection plan that offers coverage for common home repairs. Learn everything you need to know about home warranties here! Best for high coverage limits: Choice Home Warranty · Best for discounts: AFC Home Warranty · Best for membership benefits: American Home Shield · Best for. With an inexpensive home warranty repair plan from HomeServe, your covered system will be repaired or replaced, up to the benefit amount, regardless of age or. A home warranty is a yearly service contract which covers the repair and replacement of important household appliances and home system components that. A home warranty is an annual service agreement that provides coverage for repairs and replacements on home systems and appliances. Fidelity National Home Warranty - Order a home protection plan from Fidelity National Home Warranty and enjoy peace of mind in your home. The warranty provides coverage to the Seller at no cost until closing, except for any service call charge. The warranty helps to keep your home in top. The annual fee will be divided into equal monthly payments in this case. Home warranty plans can cost between $ to $ a year. Our research of 39 providers. We offer affordable home protection plans with award-winning service that help control the costs of appliance and system breakdowns.