vadimignatov.ru

Community

How Expensive Of A Home Can I Buy

Do the basic math. First, do a quick calculation to get a rough estimate of how much you can afford based on your income alone. Most financial advisors. Estimate your closing costs. Use our closing cost calculator to estimate your total closing expenses for purchasing a home. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. If you depend on the equity from your home to cover the down payment on your new house, a bridge loan can help. Many financial institutions offer this type of. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. How much house can I afford if I make $K per year? A mortgage on k salary, using the rule, means you could afford $, ($,00 x ). With a One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other. Do the basic math. First, do a quick calculation to get a rough estimate of how much you can afford based on your income alone. Most financial advisors. Estimate your closing costs. Use our closing cost calculator to estimate your total closing expenses for purchasing a home. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. If you depend on the equity from your home to cover the down payment on your new house, a bridge loan can help. Many financial institutions offer this type of. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. How much house can I afford if I make $K per year? A mortgage on k salary, using the rule, means you could afford $, ($,00 x ). With a One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other.

Use our home affordability tool to estimate how much house you can afford considering closing costs, mortgage, and additional fees and taxes. How do mortgage lenders determine how much home you can afford? When you Buy a less expensive house. Even if you are able to afford a more. You will save $,, an average of $20, per month. If you stay in your home for 1 years, renting is the cheaper option. Buying average net cost. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. For homes that cost up to $,, the minimum down payment is 5%; For homes that cost between $, and $1,,, the minimum down payment is 5% of the. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. That way you'll have. To determine how much you can afford using this rule, multiply your monthly gross income by 28%. For example, if you make $10, every month, multiply $10, Don't make the mistake of buying a house you cannot afford. A general rule of thumb is to use the 28/36 rule. This rule says your mortgage should not cost you. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. When using our mortgage affordability calculator, it helps to be accurate when estimating your monthly living expenses and additional spending. The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x. Don't make the mistake of buying a house you cannot afford. A general rule of thumb is to use the 28/36 rule. This rule says your mortgage should not cost you. You'll need at least 5% of the property purchase price as a deposit. You then borrow the rest of the money (the mortgage) from a lender, such as a bank or. And some say even higher. There are a ton of variables, and these are just loose guidelines. That said, if you make $, a year, it means you can likely. Even a % down payment, the minimum required by an FHA loan, can be expensive as homes in major cities can often go for $,, $,, or more. Most. Your housing costs: You should be spending no more than 32% of your gross income (mortgage, heat, hydro, etc.). · Your total debt: This shouldn't exceed 40% of. For a more accurate home affordability estimate, answer all of the questions below. Monthly Payment Your debt-to-income ratio (DTI) compares your monthly. Most lenders use the below ratios as guides to figure out the most you should spend on your housing costs and other debts.

Hnt Token Value

Helium (HNT) currently has a price of € and is up % over the last 24 hours. The cryptocurrency is ranked 64 with a market cap of €B. Over the last Helium price today is $ with a hour trading volume of $ M, market cap of $ B, and market dominance of %. The HNT price decreased % in. The price of Helium (HNT) is $ today with a hour trading volume of $24,, This represents a % price increase in the last Historical Helium Price Information ; Time period. High. Low ; 7 days. $ $ ; 30 days. $ $ ; 1 year. $ $ ; 5 years. $ $ Helium ($HNT) is a Proof of Coverage (PoC) based decentralized public blockchain-powered network for the Internet of Things (IoT) devices. What is the value of Helium coin? 1 Helium is worth $ How to use Helium coin in API? To get price and. Helium's price today is US$0, with a hour trading volume of $N/A. HNT is +% in the last 24 hours. What is Helium. Helium is a decentralised wireless. The live Helium Mobile price today is $ USD with a hour trading volume of $1,, USD. We update our MOBILE to USD price in real-time. Helium. The current Helium price is $ In the last 24 hours Helium price moved %. The current HNT to USD conversion rate is $ per HNT. The circulating. Helium (HNT) currently has a price of € and is up % over the last 24 hours. The cryptocurrency is ranked 64 with a market cap of €B. Over the last Helium price today is $ with a hour trading volume of $ M, market cap of $ B, and market dominance of %. The HNT price decreased % in. The price of Helium (HNT) is $ today with a hour trading volume of $24,, This represents a % price increase in the last Historical Helium Price Information ; Time period. High. Low ; 7 days. $ $ ; 30 days. $ $ ; 1 year. $ $ ; 5 years. $ $ Helium ($HNT) is a Proof of Coverage (PoC) based decentralized public blockchain-powered network for the Internet of Things (IoT) devices. What is the value of Helium coin? 1 Helium is worth $ How to use Helium coin in API? To get price and. Helium's price today is US$0, with a hour trading volume of $N/A. HNT is +% in the last 24 hours. What is Helium. Helium is a decentralised wireless. The live Helium Mobile price today is $ USD with a hour trading volume of $1,, USD. We update our MOBILE to USD price in real-time. Helium. The current Helium price is $ In the last 24 hours Helium price moved %. The current HNT to USD conversion rate is $ per HNT. The circulating.

The price of Data Credits is fixed in USD (1 Data Credit = $). Like pre-paid cellphone minutes or airline miles, Data Credits are non-transferrable, and. Helium (HNT) is a cryptocurrency launched in Users are able to CRV-USD Curve DAO Token USD. +%. ENJ-USD Enjin Coin USD. + 27 August - The Helium price today is USD. View HNT-USD rate in real-time, live Helium chart, market cap and latest Helium News. The current price of Helium (HNT) is USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what coins are. The live price of Helium is $ per (HNT / USD) with a current market cap of $ B USD. hour trading volume is $ M USD. HNT to USD price is. Helium aims to provide a "peer-to-peer wireless data network that anyone can access" by using HNT tokens as an incentive for users to build and maintain the. The current market cap of HNT is $B. It is calculated by multiplying the current supply of HNT by its real-time market price of $B. Helium Helium is a form of digital cryptocurrency, also referred to as HNT Coin. Use this page to follow the Helium price live, cryptocurrency news, Helium. Today's price of HNT is $, with a hour trading volume of $ HNT is % in the last 24 hours, with a circulating supply of M HNT coins and a. Easily convert Helium to US Dollar with our cryptocurrency converter. 1 HNT is currently worth $ The live Helium price today is $ with a hour trading volume of $M. The table above accurately updates our HNT price in real time. The price of HNT. Crypto experts are constantly analyzing the fluctuations of Helium. Based on their predictions, the estimated average HNT price will be around $ It might. The price of Helium (HNT) is $ today, as of Aug 31 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has increased. Helium (HNT) is currently ranked as the #57 cryptocurrency by market cap. Today it reached a high of $, and now sits at $ Helium (HNT) price is up The price of Helium Mobile (MOBILE) is $ today with a hour trading volume of $1,, This represents a % price decline. Value statistics ; $ · BTC · · $ million · $ million. The live price of Helium (HNT) today is USD, and with the current circulating supply of Helium at ,, HNT, its market capitalization. The live price of Helium is $ per (HNT / USD) today with a current market cap of $B USD. The hour trading volume is $M USD. HNT to USD price is. Live HNT Price Analysis. The current real time Helium price is $, and its trading volume is $5,, in the last 24 hours. HNT price has grew by % in.

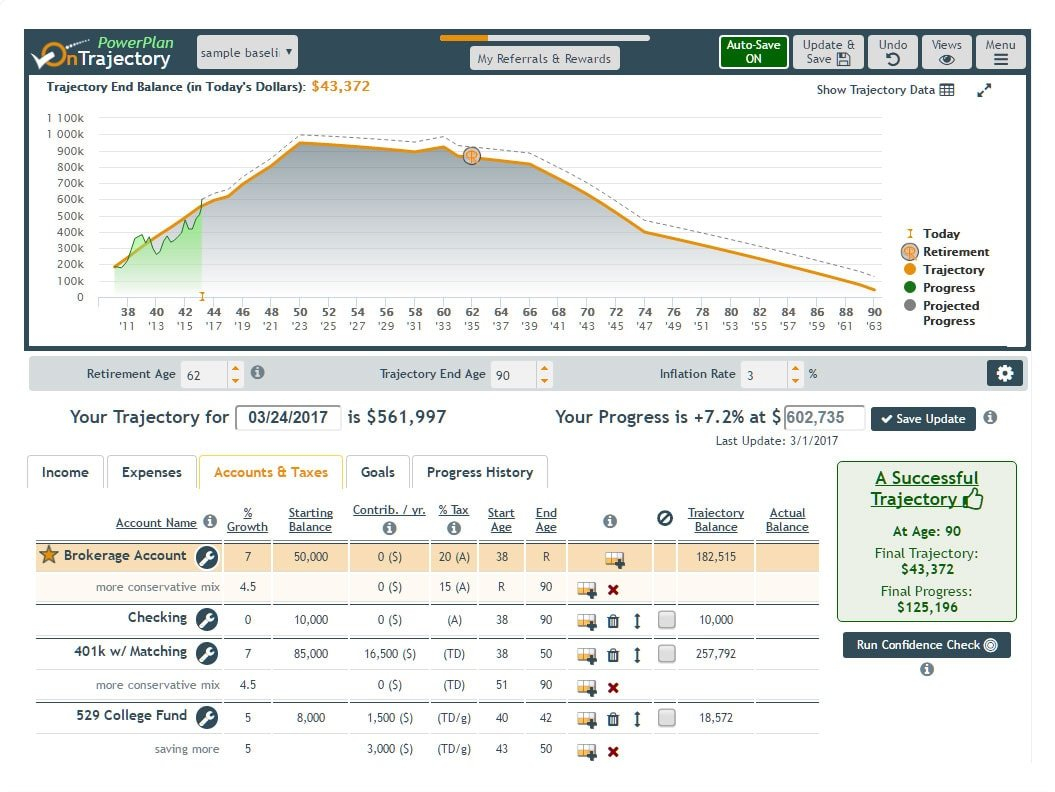

Best Retirement Plan Calculator

The T. Rowe Price Retirement Income Calculator and MaxiFi Planner are two of the best tools. It is important to keep in mind that retirement calculators rely on. This calculator will allow you to generate an estimate of your future retirement benefits, however, it does not replace the actual calculation of benefits when. How much income will you need in retirement? Are you on track? Compare what you may have to what you will need. Planning for retirement starts with a goal. Orange Money® is the money you save for tomorrow, today. myOrangeMoney® will show you the future monthly income you. Learn just how prepared for retirement you are by using Fidelity's retirement score tool, which assess your retirement savings and monthly contributions to. Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. Are you saving enough money for retirement? Use our retirement savings calculator to help find out how much money you need to save for retirement. Our retirement calculator and planner estimates monthly retirement income and efficient retirement savings spending, providing useful financial insights. Are you saving enough for retirement? SmartAsset's award-winning calculator can help you determine exactly how much you need to save to retire. The T. Rowe Price Retirement Income Calculator and MaxiFi Planner are two of the best tools. It is important to keep in mind that retirement calculators rely on. This calculator will allow you to generate an estimate of your future retirement benefits, however, it does not replace the actual calculation of benefits when. How much income will you need in retirement? Are you on track? Compare what you may have to what you will need. Planning for retirement starts with a goal. Orange Money® is the money you save for tomorrow, today. myOrangeMoney® will show you the future monthly income you. Learn just how prepared for retirement you are by using Fidelity's retirement score tool, which assess your retirement savings and monthly contributions to. Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. Are you saving enough money for retirement? Use our retirement savings calculator to help find out how much money you need to save for retirement. Our retirement calculator and planner estimates monthly retirement income and efficient retirement savings spending, providing useful financial insights. Are you saving enough for retirement? SmartAsset's award-winning calculator can help you determine exactly how much you need to save to retire.

Use online retirement calculator to see how much you need to save for retirement. You can get a personalised result by filling in your income and other. Best retirement calculators? · Smart Assets Retirement Calculator which is the most in depth one I've found to date, but might be overkill for. Explore our financial planning tools, calculators, and resources to help you stay on track with your financial goals and plan for the future. Roth (k) vs. Traditional (k)? Decide whether a traditional (k) or Roth (k) might be the best employer-sponsored retirement plan option for you. Use these free retirement calculators to determine how much to save for retirement, project savings, income, K, Roth IRA, and more. Manage benefits. Plan for retirement. Apply for your monthly retirement benefit any time between age 62 and We calculate your payment by looking at how. Retirement Planner - It helps you figure out the amount you need to invest regularly to meet your Financial goal. Whether you are looking for a retirement score or a retirement income calculator, Fidelity's retirement tools & calculators can help you plan for your. Advantages of Groww's Retirement Calculator Like most reliable online retirement calculators, this Groww calculator is a specially designed financial tool to. Use SmartAsset's (k) calculator to figure out how your income, employer Infographic: Places with the best (k) benefit plans. Share Your Feedback. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. This is the best retirement calculator on the Web. Model multiple post-retirement income streams. Try Financial Mentor's Ultimate Retirement Calculator now. Retirement Advisor. A powerful retirement calculator that helps you determine how much to save, how to invest, and how much income you'll have. The Yieldstreet Retirement Calculator can help you determine the right time to retire based on your goals and anticipated income requirements. Input your. The retirement calculator will help you understand how much corpus you need to create before you retire and how to plan for it. Here are the ways in which it. Out of all the "very quick and basic/free" ones, I've liked this one the best: vadimignatov.ru Retirement planner calculator · Retirement plan inputs: · Investment returns, inflation and Social Security: · Retirement savings runs out at age · Definitions. The retirement calculator allows you to choose the right mutual fund schemes as you know how much you have to save and gives you the time-frame as well. 1. Empower: Retirement Planner · 2. Betterment: Retirement savings calculator · 3. Stash: Retirement accounts · 4. CountAbout's FIRE widget · 5. Fidelity: myPlan. One rule of thumb is that you'll need 70% of your annual pre-retirement income to live comfortably. That might be enough if you've paid off your mortgage and.

Borrowing From An Ira For Home Purchase

Alternatives to using a (k) loan for a home purchase · Make a (k) withdrawal · Take a (k) distribution · Withdraw from your IRA · Use a low-down-payment. Hardship withdrawals cannot be rolled back into the plan or to an IRA. Non-hardship withdrawals can generally be taken for any purpose but are typically limited. However, you can withdraw up to $10, in Roth IRA earnings, penalty-free, to put toward a home purchase if you've had a Roth account for at least five years. Many (k) plans allow you to borrow from your account to buy a home, pay education or medical expenses or prevent eviction or mortgage default. In general. private mortgage insurance (PMI)An insurance policy that protects the lender in case you default on your loan. Mortgage insurance is required for FHA loans and. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. With current interest rates I am debating whether I should pull out K from a rollover IRA that I had, after taxes and penalty would probably. Normally, you may borrow up to $50,, or 50% of your vested account balance. Before borrowing or withdrawing from a (k) or IRA, however, you should. If you qualify as a first-time home buyer, you can withdraw up to $10, from your IRA to use as a down payment (or to help build a home) without having to pay. Alternatives to using a (k) loan for a home purchase · Make a (k) withdrawal · Take a (k) distribution · Withdraw from your IRA · Use a low-down-payment. Hardship withdrawals cannot be rolled back into the plan or to an IRA. Non-hardship withdrawals can generally be taken for any purpose but are typically limited. However, you can withdraw up to $10, in Roth IRA earnings, penalty-free, to put toward a home purchase if you've had a Roth account for at least five years. Many (k) plans allow you to borrow from your account to buy a home, pay education or medical expenses or prevent eviction or mortgage default. In general. private mortgage insurance (PMI)An insurance policy that protects the lender in case you default on your loan. Mortgage insurance is required for FHA loans and. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. With current interest rates I am debating whether I should pull out K from a rollover IRA that I had, after taxes and penalty would probably. Normally, you may borrow up to $50,, or 50% of your vested account balance. Before borrowing or withdrawing from a (k) or IRA, however, you should. If you qualify as a first-time home buyer, you can withdraw up to $10, from your IRA to use as a down payment (or to help build a home) without having to pay.

But you can use non-recourse IRA loan proceeds to purchase income-producing investment property. Profits are reinvested in the IRA, while remaining IRA. According to the IRS, you can use up to $10, from your IRA towards a first-time home purchase without incurring the early withdrawal penalty. The IRS permits a self-directed IRA to purchase or hold domestic or foreign real estate. The Self-Directed IRA is used for tax-free or tax-deferred investment. How much can I borrow? · The minimum loan amount is $1, or an amount specified by your retirement plan · The maximum loan amount is the lesser of 45% of the. Unfortunately, loans from an IRA are not permitted. However, there is an alternate option: you can withdraw funds from your IRA to purchase a home. It's. Another potentially positive way to use a (k) loan is to fund major home improvement projects that raise the value of your property enough to offset the fact. If you are purchasing your first house, you are allowed to withdrawal up to $10, from your Traditional IRA and avoid the 10% early withdrawal penalty. You. Clients that utilize an eligible IRA account balance to qualify for certain discounts may qualify for one special IRA benefit package per loan. This includes an. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. IRAs (including SEP-IRAs) do not permit loans. If this transaction was attempted, the IRA could be disqualified. Return to List of FAQs. 3. What happens if a. In most cases, you'll have to repay a (k) loan over a period of five years — however, that restriction is waived if you're using the money to purchase a. A Non-recourse loan is a unique type of financing popular for real estate investments in IRAs where the IRA is the borrower. Unlike traditional loans where. As a result, your take home pay will be reduced by the amount of the loan payments. Make sure you are able to afford both the (k) loan payment and the new. Distributing up to $ from an IRA before age 59 1/2 for a first home purchase is one of the exceptions to the 10% early distribution penalty. You can withdraw $10k of earnings from your own Roth Ira account for house purchase subject to account being open for at least 5 years and. Here's what to watch out for: You'll need to repay the loan in full or it can be treated as if you made a taxable withdrawal from your plan — so you'll have to. As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. Anyone who has at least % of the purchase price vested in a self-directed IRA has the opportunity to buy rental properties using a non-recourse loan. This. After you borrow, you generally have five years to pay back your (k) loan with interest and will not owe taxes for borrowing from your (k). Another option.